Okay. I admit. Sometimes, I consider myself an OC (obsessive compulsive) when it comes to planning.

I began preparing to quit my job as soon as I learned about investing when I was 30. I have this goal of being unemployed to pursue my passion by the time I reach 40. Proudly, I was able to do it and became a Full Time Insular Life Financial Advisor at age 35.

It was five years ago when my husband and I began preparing for our kids' college fund. We have also began preparing for their place to stay as we have been paying for a condo unit for the past year.

My one and only dream travel destination is currently four years in the making. I wanted to do something significant for my 40th birthday.

I also enjoy planning what treats my daughters will give to their classmates during Valentines Day, Halloween, Christmas, and most especially during their birthdays. My kids and I began to plan for their coming birthdays last year!

Maybe this is the reason why my career as a Financial Planner suits me best. I love learning and teaching about insurance and investments, and I love planning. Obviously.

Last Night, January 8, I Bought My First Gift For Christmas

Christmas last year was my first Christmas celebration as unemployed. This means that for the first time, from my 15 years of being employed, I did not have a Christmas Bonus. No Christmas basket either, nor sick leave conversion.

And honestly, it was an adjustment period for me. In addition to that, my separation pay was not yet released, which I was expecting before 2018 ended. I also thought that I could sell my shares from an investment. That didn't happen either.

With that experience, I needed to come up with a new strategy. Or I'd rather say, better planning skills. This time, everything will depend on me -- not on a pending final pay nor money which I have no full control of.

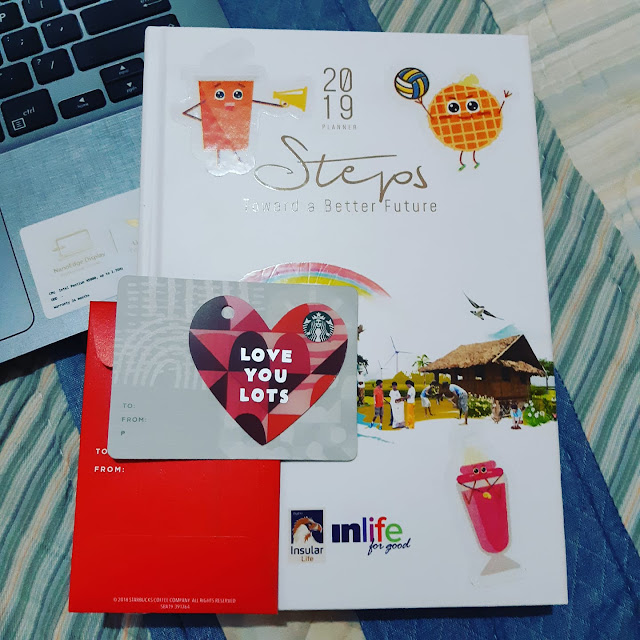

This is the reason why last night, on my way home to Tarlac, I went to Stabucks to purchase my very first gift for Christmas 2019 -- a Starbucks gift card!!!

Crazy you may think. Who starts planning for Christmas in January, right? Well, I do. Let me share with you the reasons why I did so...

1. Because Christmas is still 12 months away and I plan to buy gifts monthly, shedding cash is easy on the pocket. I am sure you would agree that spending Php2,000 monthly (more or less) is better than cashing out Php24,000 one time. Think INSTALLMENT.

2. Because I am not rushing, I free myself from stress. Is the traffic on your way to the mall, or length of time to get a parking, or long lines in the cashier and gift wrapping section still fresh in your memories? I do not want to go through that. Even this gift card was purchased via drive thru. NO LINES.

3. I started practicing minimalism, and I want to try that in gift giving this year. No gift wrapping and gift tags needed. This may be just a gift card, but still way better than giving cash. This is well thought of as its recipient loves coffee, very much.

While in the process, this is what I realized. Preparing for Christmas is like preparing for retirement. Both needs PLANNING.

I remembered what my ten-year-old daughter told me last year. It was not even December yet when she was done with all of her Christmas gifts -- bought, wrapped, tagged and all. She was literally just waiting for the date. And during that time, I haven't even began mine. I was dilly dallying. And this is what she said, "Mommy, Christmas ung best occasion tapos hindi mo paghahandaan?!?" Right there and then, I knew that my daughter will do way better than me in planning, and I also felt guilty. What she said made so much sense. And for a ten year old, that was definitely something.

And if we need to prepare for Christmas which occurs year after year, how much more for retirement which is supposedly the most forward looking years of every working individual's life?

And here are some points that you may consider with regards to retirement planning.

1. Just like Christmas, you know when your retirement will happen. Will it be at the newly approved age of retirement for government workers which is 56? Will it be at 60? Or 65? How many years away are you from that age?

2. Based on your average Christmas spending, you have a rough estimate of how much you would need for this Christmas. The same applies with your retirement. Your target retirement fund is based on your average annual spending. If a client tells me that he/she wants to invest for retirement, this is what I ask him/her -- "If you were to retire today, how much would you need?" With his/her given answer, long term inflation rate, client's risk appetite and investment's rate of return, I do the Math and present it to them. The last thing you would want is to delay your retirement or live uncomfortably because your retirement fund is way below what you actually need.

3. With all these numbers, you would know how much do you really need to invest today so that you can live the same lifestyle (if not better) that you have by the time you retire. And take note that the more you delay, the bigger amount you would need to invest since time is money's best friend.

Final Note

There is a reason to fear retirement. That is if you are not preparing for it.

Instead of retirement being something to fear, make it an event that you will look forward to, something that you will be excited about. Begin RETIREMENT PLANNING TODAY! Be that someone who prepares for Christmas in January. Better yet, be that someone who prepares for retirement now. My youngest clients began preparing for retirement at age 21! (I will write about this in a different blog post.) Have that courage to go against the crowd. I urge you to inspire change and break that sandwich generation in your families.

Send me an email at financialplanningforpinoys@gmail.com with the subject RETIREMENT PLANNING and I will do a FREE computation for you. You may also visit our webiste at http://synergiainsurance.com.

Wishing you all the best and a year closer to your financial goals this 2019! Cheers!