|

http://www.flickr.com/photos/37849706@N07/8775966241

|

Yesterday, I had the chance to chat with my friend on Facebook. Although she and I were not formally introduced, she left the company before I could personally meet her, I am glad that we talk as if we have known each other for a long time. Even until now, we have not met yet. But that is the beauty of social media. It does not only reconnect you with people you've known in the past, but it connects you to new people that are yet to come into your life.

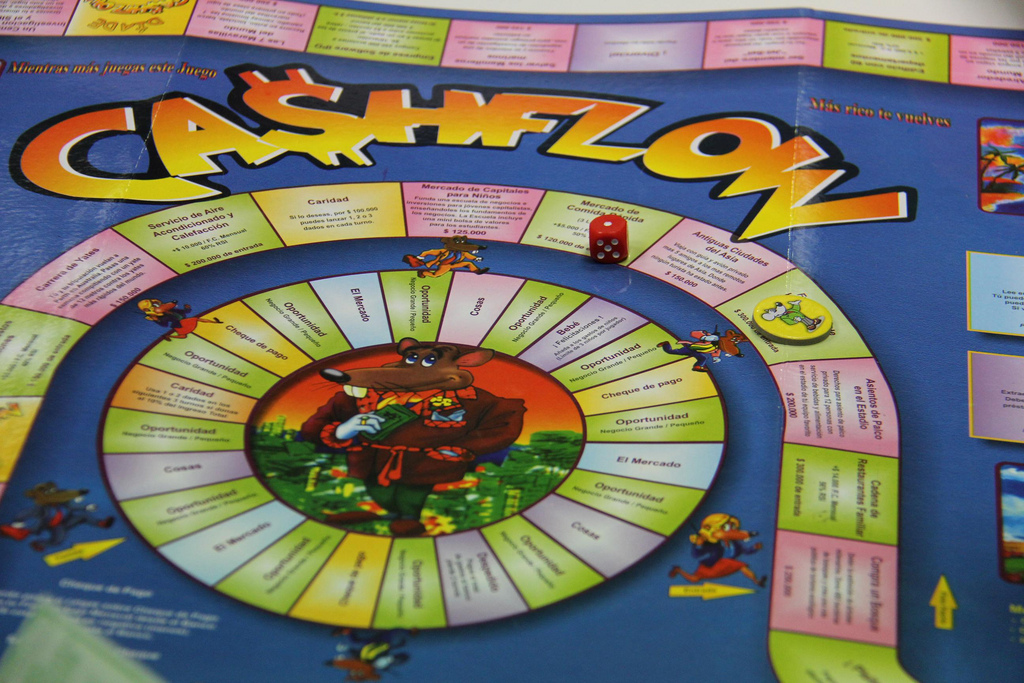

At the end of our conversation, she invited me to join her in playing Cashflow 101 next month. It was perfect timing, because I have been looking for venues where I could try playing that game.

What is Cashflow 101?

According to Wikipedia, Cashflow 101 is an educational tool in board game format designed by Robert Kiyosaki (author of Rich Dad, Poor Dad), which aims to teach the players concepts of investing by having their money work for them in a risk free setting (play money) while simultaneously increasing their financial literacy and stressing the imperative nature of accountability.

The board game is based in a financial and economic simulation environment.

There are two stages to the game. In the first, "the rat race", the player aims to raise his or her character's passive income level to where it exceeds the character's expenses.

The winner is determined in the second stage, "the fast track". To win, a player must get his or her character to buy their "dream" or accumulate an additional $50,000 in monthly cash flow.

In place of “score cards”, there are financial statements. The game requires the players to fill out their own financial statements so that they can see more clearly what is happening with their money. It generally shows how assets generate income and demonstrates that liabilities and 'doodads' are expenses.

The Purpose of Playing Cashflow 101

According to Robert Kiyosaki, he designed the game with two tracks, the Rat Race and the Fast Track, because to him, this game is the real game of life -- that each of us is on one track or the other.

Playing the game teaches you how to get out of the Rat Race. Its purpose is to open your mind to the possibility of you becoming rich and financially free from the Rat Race, free from the drudgery of spending your life working for money and living below your means.

Kiyosaki suggests playing the Cashflow 101 at least a dozen times, until you get out of the Rat Race in less than an hour, regardless of your profession, your salary, high or low, and what market conditions or setbacks you encounter in the game.

Fully Booked!

I called up the organizer today and unfortunately for others, registration has been closed. Fortunately for me, my friend was able to sign me up before yesterday before all slots were taken. Now that is what I call perfect timing!

Due to limited slots and all are taken, the organizer of this Cashflow 101 Game will be holding another event in the future. With my own personal experience after playing the game, I will be posting the details as soon as it is available.

Reference: